Located between Nashville, Knoxville, and Atlanta, Chattanooga is a rising metro known for innovation and regional economic strength. Dubbed “Gig City,” it was the first U.S. city to deploy 1 gigabit-per-second internet (in 2010) and has since expanded to offer America’s first 25 gigabits per second community-wide via its all-fiber EPB network.

Chattanooga’s economy is anchored by six large sectors that collectively employ a significant portion of the region: Trade, Transportation & Utilities (20%), Manufacturing (20%), Education & Health Services (14%), Government (13%), Leisure & Hospitality (10%), and Professional & Business Services (10%). Major employers and economic pillars include Volkswagen (4,500 jobs), BlueCross BlueShield (4,145 jobs), Unum Group HQ (3,082 jobs), and Amazon (1,472 jobs), among others.

The healthcare sector is anchored by Erlanger Health System (5,994 jobs / 911 beds), CHI Memorial (3,722 jobs / 466 beds), and Parkridge Medical Center (1,448 jobs / 275 beds).

In higher education, the University of Tennessee at Chattanooga (UTC) enrolls 11,834 students, while Chattanooga State Community College serves more than 10,000 undergraduates.

Contributing to Chattanooga’s rise is its ability to attract business and capital investments. In 2024-25, Chattanooga welcomed over $1 billion in capital investment and 800 new jobs as part of its ‘Chattanooga Climbs’ multi-year initiative.

Chattanooga is also nationally celebrated as an outdoor destination, boasting over 50,000 acres of parks, wilderness areas, and trails within a short drive of downtown—perfect for hiking, climbing, and river activities. The revitalized riverfront is a cultural gem, home to gems like the Tennessee Aquarium (a nationally top-ranked facility) and the Creative Discovery Museum.

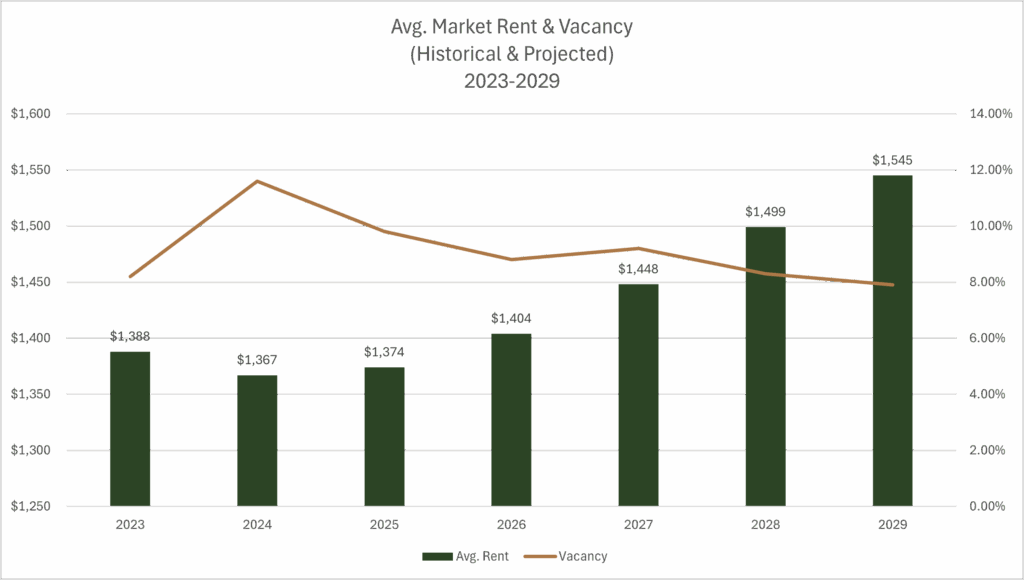

On the multifamily front, the Chattanooga MSA is home to 204 apartment communities (50+ units), totaling 31,133 units, with 3 properties (556 units) currently under construction.